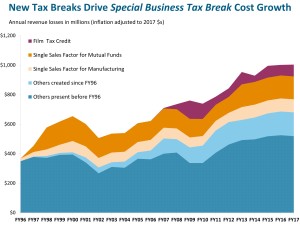

A new study by the Massachusetts Budget and Policy Center (MassBudget) shows that the cost to the state from special business tax break spending has nearly tripled, even after adjusting for inflation, from $370 million in 1996 to over $1 billion anticipated in this fiscal year.

[caption id="attachment_7075" align="alignright" width="300"] Much of the growth in the cost has been driven by three major, industry-specific tax breaks enacted over the past 20 years: tax breaks for manufacturing companies, tax breaks for mutual fund companies and tax breaks for movie production companies.[/caption]

Much of the growth in the cost has been driven by three major, industry-specific tax breaks enacted over the past 20 years: tax breaks for manufacturing companies, tax breaks for mutual fund companies and tax breaks for movie production companies.[/caption]

These tax breaks are a major cause of the budget deficits and budget cuts that have happened over the last 12 years with significant cuts in the budget approved in July and possibly more emergency 9C budget cuts coming in the next month.

The Local 888 backed Raise UP MA campaign to pass the Fair Share Amendment to raise $2 Billion for education and transportation is to make needed investments in these vital areas of opportunity. This funding would come available in 2019-2020 if this passes in 2018.

But a fair and good way to deal with the current budget cuts this year could be to consider scaling back some of these special business tax breaks.

Click here to read Massachusetts Budget and Policy Center report